CRM Finance

KYC and Onboarding

KYC is predominantly a risk mitigation technique designed to prevent financial services firms from being used, intentionally or unintentionally, for illicit or illegal activities.

KYC is predominantly a risk mitigation technique designed to prevent financial services firms from being used, intentionally or unintentionally, for illicit or illegal activities.

Sign up to get FREE CRM Trial

Know Your Customer processes are designed to verify client identity, adhere to banking regulations and comply with a plethora of compliance measures such as anti-bribery, identity theft, money laundering and terrorist financing. The most common KYC processes focus on client onboarding (i.e. client identity), new policy onboarding and monitoring of client financial transactions.

From an operational perspective, using onboarding process guides in the CRM Finance increases ease of use, ensures compliance steps (both the sequence and completeness of steps) and provides a visual queue of where a client’s process stands at any point in time. The CRM Service can also then be used for client or KYC alerts, notifications and reporting, such as the Incomplete KYC report I create for pretty much every financial services client. Below are two sample illustrations of onboarding process guides that are part of the client contact record in the CRM Finance. The first is a 5 stage KYC new customer onboarding and the second is a 4 step new Life Insurance policy.

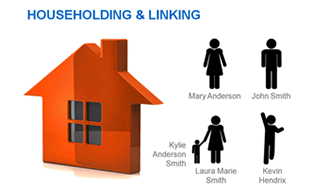

Householding

Few financial services firms fully recognize the household relationships among their customers – which results in a significant lost opportunity for up-sell, cross-sell and growing client relationships. The householding process I’ve implemented using CRM software can start simple. For example, use a query to show all customers that have the same home telephone number or the same home address, and then apply a workflow or business rule to link those accounts using a Relationship field. When an Advisor recognizes that a credit card holder is the 16 year old daughter of portfolio customer who is her father, he can use that information to suggest auto insurance policies, college financing options or getting the daughter started in an early savings plan or even a portfolio plan that matches some of the father’s plan elements.

Few financial services firms fully recognize the household relationships among their customers – which results in a significant lost opportunity for up-sell, cross-sell and growing client relationships. The householding process I’ve implemented using CRM software can start simple. For example, use a query to show all customers that have the same home telephone number or the same home address, and then apply a workflow or business rule to link those accounts using a Relationship field. When an Advisor recognizes that a credit card holder is the 16 year old daughter of portfolio customer who is her father, he can use that information to suggest auto insurance policies, college financing options or getting the daughter started in an early savings plan or even a portfolio plan that matches some of the father’s plan elements.

Compliance

Compliance in the financial services industry is a lot like safety in the airline industry. Its non-conditional and even small deviations can produce devastating effects. Fortunately, compliance mandates can be facilitated with CRM applications. In fact when client compliance requirements are embedded within the CRM solution the processes can be automated using the data captured in the KYC and onboarding processes. This greatly accelerates cycle times, decreases manual activities and reduces the number of applications that then have to be integrated and managed.

Compliance in the financial services industry is a lot like safety in the airline industry. Its non-conditional and even small deviations can produce devastating effects. Fortunately, compliance mandates can be facilitated with CRM applications. In fact when client compliance requirements are embedded within the CRM solution the processes can be automated using the data captured in the KYC and onboarding processes. This greatly accelerates cycle times, decreases manual activities and reduces the number of applications that then have to be integrated and managed.

Client Account Management

It’s important to remember that while compliance is mandatory, the business purpose is to acquire and grow customer relationships. Fortunately, when designed in a holistic way, compliance measures can actually feed business development processes.

It’s important to remember that while compliance is mandatory, the business purpose is to acquire and grow customer relationships. Fortunately, when designed in a holistic way, compliance measures can actually feed business development processes.

Financial services client account management techniques are many and varied. However, an approach somewhat popular in North America and the Caribbean is the FORM technique. FORM stands for Family, Occupation, Recreation and Monetary and seeks to capture data in these categories in order to understand what’s important to each client and leverage this information for relationship building.

A Holistic Solution

Financial services companies often struggle with a slew of legacy systems, disparate data siloes, system integration headaches, complex reporting and manual efforts that frustrate users and increase business process cycles. Fortunately, it doesn’t need to be this way. Some forward thinking design of an enterprise-wide customer management system that includes the many compliance requirements along with business development objectives will result in fewer systems, more automation and greatly improved user satisfaction

Financial services companies often struggle with a slew of legacy systems, disparate data siloes, system integration headaches, complex reporting and manual efforts that frustrate users and increase business process cycles. Fortunately, it doesn’t need to be this way. Some forward thinking design of an enterprise-wide customer management system that includes the many compliance requirements along with business development objectives will result in fewer systems, more automation and greatly improved user satisfaction

To find out more about CRM Finance, click here

to conduct a free call.