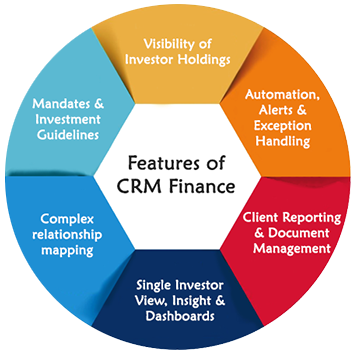

CRM Finance Features

Visibility of Investor Holdings

The ability to view an Investor’s underlying investment and entire holding. As outlined earlier these can be complex due to investment made via custodians, nominees etc. Firms can use CRM Finance to help map these transaction to the Underlying Beneficial Owner (UBO) ensuring that the firm has a complete view of an investor. The relationship management aspects of the CRM Finance should allow fund managers to identity potential investments against investors and funds. Reporting these potential investments or indeed redemptions means that a fund manager has a good understanding of the likely (future) size of the fund based upon expected inflows and outflows.

Sign up to get FREE CRM Trial

Automation, Alerts and Exception Handling

In CRM Finance with the wealth of information available and the need to move faster, rising investor expectations and with frankly less resources than before Asset Managers are looking to automate as much as possible. Rather then manage each process it is about surfacing issues when they occur and manage by exception.

Client Reporting & Document Management

With increasing sophisticated requirements from investors, fund managers are required to deliver personalised and tailored investment reports. As Asset managers increase their institutional investor base (e.g. pension funds) then the complexity of the reporting increases. The need to store documents across the investor and investment lifecycle, including client reports, attribution and risk reports and so on, firms want to centralise the document storage, control versioning, manage both the structured data (e.g. performance) as well as unstructured (e.g. fund manager commentary) and they need to see all this information against an investor record.

Single Investor View, Insight & Dashboards

The ability to see a single Investor and underlying holdings. Dynamics can provide the integration layer across back office systems (integration or view). This is what I often call the “single point of entry”, which is to say that Microsoft Dynamics CRM becomes the “authoritative source of data” the place where people go to see client data with confidence. Microsoft Dynamics CRM does not need to be the golden source but it does surface this information in a single user interface. We have seen great success in user adoption because we are removing multiple applications and replacing it with Outlook (or the web client for those who do not have Outlook).

Complex relationship mapping

In CRM Finance the ability to store and view the complex relationships from the Asset Managers perspective as well as from the Investor and any third party relationships that might be involved in the deal or relationship. With many parties involved, firms need to map Investors, Custodians, Nominees, Consultants and Advisors in order to fully understand the complexity and stakeholders in a relationship.

Mandates and Investment Guidelines

CRM Finance Firms need to be able to capture mandates and investment guidelines from the Investor. Capturing this information is key not only from a regulatory perspective but also for increasing a client investment in the fund(s).

To find out more about CRM Finance, click here![]() to conduct a free call.

to conduct a free call.