CRM Finance key features to Succeed

Getting CRM right can always be somewhat of a struggle for most businesses, but the Financial Services industry in particular is under a lot of pressure to make sure customer and client interactions are of consistent quality. Everyone is talking about ‘Customer Excellence’, but those who want to have a customer orientated business don’t always know how to best utilise technology to support that approach. Here are 5 tips from the Outbox team on making sure your CRM provides value.

Sign up to get FREE CRM Trial

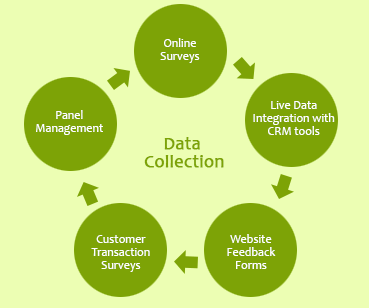

Capture customer data at every opportunity

In order to improve customer experience and provide value at every turn, relevant data needs to be accessible and available at all times, from anywhere. Most importantly that data needs to be accurate, which requires a tight integration with applications across the organisation. The approach towards what customers need should be proactive rather than reactive, which means having a tightly integrated and automated CRM service that collects data from every customer touchpoint. This way you can ensure a CRM strategy equates to improved customer loyalty and satisfaction.

Make sure customers can access services with ease on any device

Make sure customers can access services with ease on any device

Becoming a ‘Digitally Mature’ organisation, or a member of the elusive ‘Digirati’ is on the agenda for a lot of Financial Services companies, especially as consumer behaviour shifts heavily toward increasingly digital activities like mobile banking. It doesn’t matter whether you’re handling pensions or hedge funds, clients and customers want to be able to have access to services across all channels. Making this experience not only possible, but seamless, is absolutely essential.

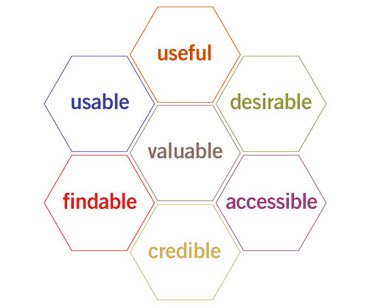

Always keep User Experience in mind

Always keep User Experience in mind

When attracting and retaining new clients is more difficult than ever, organisations need to ensure they can instantly adapt their offering to each individual client. Any CRM solution worth its salt should be capable of streamlining processes, making everything from onboarding to upgrading completely painless.

Proactively respond to changing regulations

Another increasingly important aspect of CRM for all companies, especially those that handle financial as well as personal data, is regulation. The EU has been introducing an array of privacy directives, which has had an enormous impact on everything from how organisations operating in the member states conduct online marketing to how and where they store customer data. Whilst protecting consumers, these changes will have drastically change the way those in the finance industry do business – data control and CRM will need to be closely watched by those responsible.